Tax Deducted At Source (TDS)

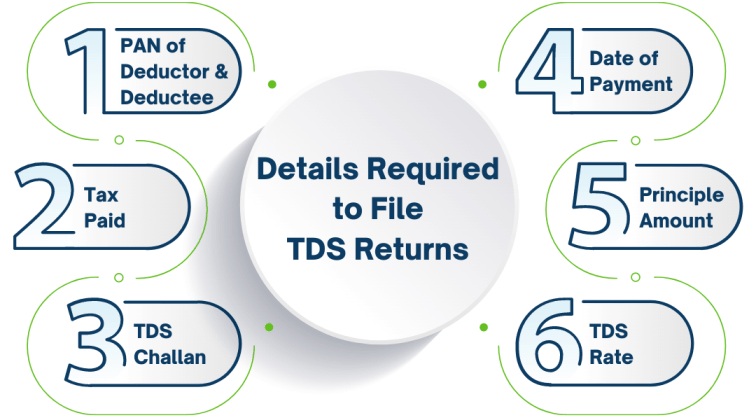

Required Details

Guide for Uploading TDS Returns on the Income Tax Portal

If you have earned specific income and TDS has been deducted from it, the government must pay the TDS deducted and file a return. The Return should be uploaded to the TRACES portal. Filing and complying with data procedures is a tedious process. Hence, the income tax portal has provided for uploading the return on its own website.

Filing and complying with data procedures is a tedious process. Hence, the income tax portal has provided for uploading the return on its own website.

Go to https://easyfilling.org

Click on ‘e-File’, then ‘Income Tax Forms’ and then ‘File Income Tax Forms’ from the dashboard.

Proceed to ‘Upload TDS Form’: Click on the ‘Let’s Get Started’ option. Upload TDS format

Validate the return using the OTP sent to the registered mobile number to complete the process.

Forms for Filing TDS

There are different types of TDS return forms, depending on the purpose of the deduction:- Particulars of the payment Form No. TDS on Salary Form 24Q TDS when the deductee is an International Firm or Non-Resident Indian(NRI) Form 27Q TDS on payment made for transferring any immovable property Form 26QB TDS for Others Form 26Q

Salary income

Income on securities

Insurance commissions

Payouts towards NSC

Earnings from winning horse races, lotteries, sources.

Frequently asked questions

When is the TDS return due date?

The TDS return due date is typically on the 31st of July for the first quarter, 31st of October for the second quarter, 31st of January for the third quarter, and 31st of May for the fourth quarter of the financial year.

What is the due date for filing TDS return?

The due date for filing TDS return is on or before the 31st of July for the first quarter, 31st of October for the second quarter, 31st of January for the third quarter, and 31st of May for the fourth quarter of the financial year.

How can I file TDS return online?

What is the TDS return filing due date for FY 2020-21?

The TDS return filing due date for FY 2020-21 is on or before the 31st of July 2021 for the first quarter, 31st of October 2021 for the second quarter, 31st of January 2022 for the third quarter, and 31st of May 2022 for the fourth quarter.

Timely delivery of website is our main priority and we wish to fulfill that each and every time.

IMPORTANT LINK

Copyright © 2024 EasyFilling Pvt. Ltd. All rights reserved.